The Procrastinator’s Guide to Taxes

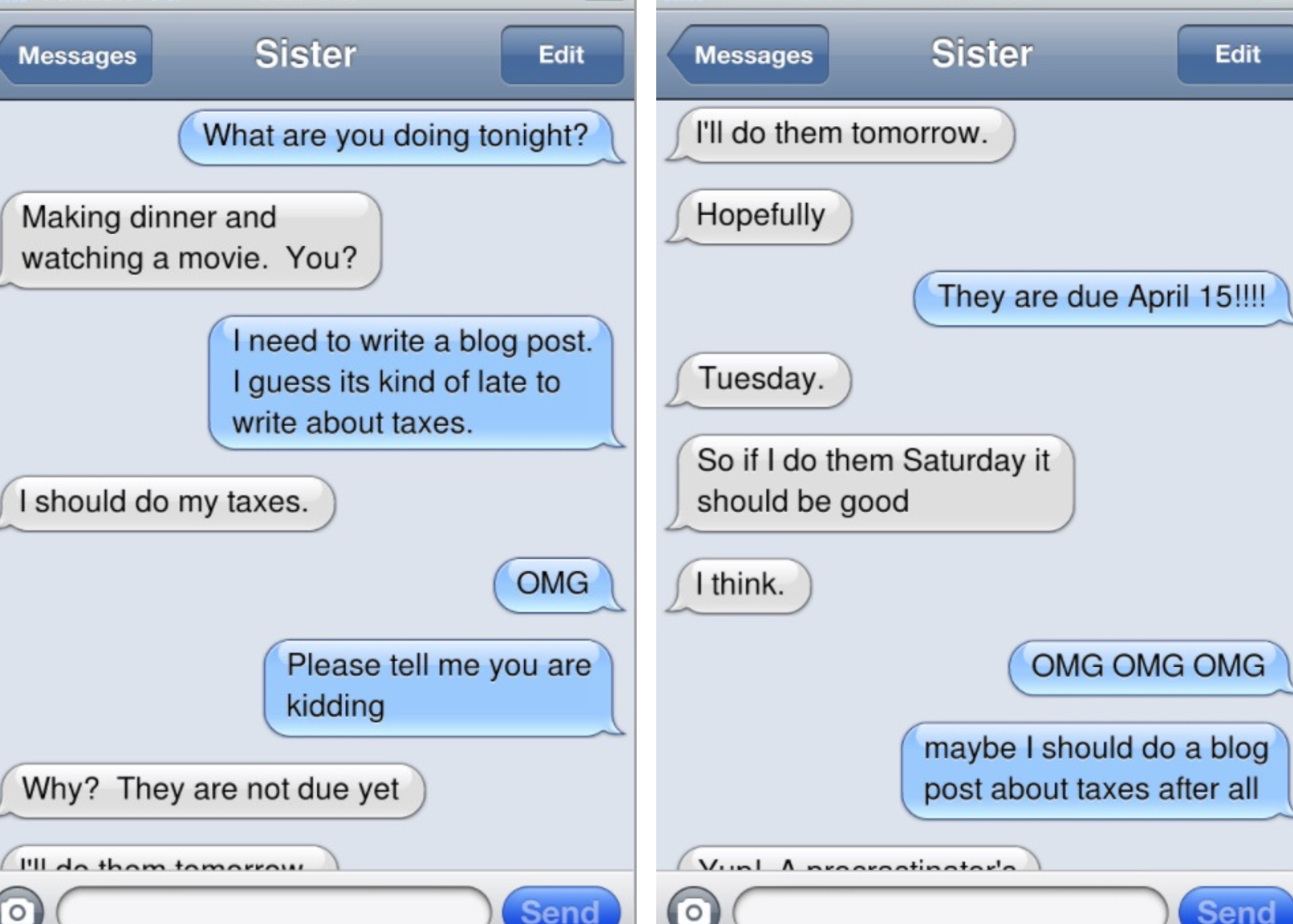

A few years ago, I was chatting with my sister and had this conversation:

She suggested I write a Procrastinator’s Guide to Taxes - so here you go!

Why is tax day later this year?

Tax Day is April 18 this year and I thought it was because it fell on a weekend, which would push it back to Monday. But Monday is an official holiday too! I found out that the District of Columbia Compensated Emancipation Act was signed into existence by President Lincoln on April 16, 1862. This holiday is only officially observed in D.C. (other states have different emancipation dates), but since that is the home of the IRS, guess who is taking the day off?

So, you now have until Tuesday to file your taxes - now what?

Gather all your documents.

The good news is that most documents can be found online, even if they are mailed to you.

All income received (W-2 forms, 1099 Forms, etc.)

All income adjustments (health insurance, retirement contributions, mortgage interest, student loan interest, etc.)

All tax credits and deductions (education costs, medical expenses, business expenses, etc.)

Decide how and who will do your taxes.

You have a few options depending on your personal situation.

Do them yourself online. I have used both TaxAct.com and Turbotax.com, but I would not spend any more time researching them, just pick one.

Make an appointment with a tax service like H&R Block. If you do this, you must go online right now, and find somewhere that has an appointment open.

I do not recommend filling out your form by hand, unless you are using the 1040EZ Form.

If you come to the conclusion that you will not be able to file your taxes on time, due to extenuating circumstances, you can file an extension. This is not an ideal situation because you will more than likely still have to pay a penalty fee plus interest.

Decide when you are going to file.

Not just push the “send” button but actually sit down and fill out all the information. If it is already late at night, do not start anything now, unless you are a nightowl and become extremely alert the later it gets. I also do not recommend starting them on Monday. That leaves you Saturday and Sunday. Unless you actually work in D.C. or for the IRS, you will probably have to work on Monday. So that leaves us with….Saturday! That’s right. Start working on them on Saturday. If you don’t finish, you will still have a few days to finish them.

This is really important. I know you might feel like you have waited this long, so why spoil your weekend? But investing just a few hours on Saturday morning could make the difference of being able to enjoy your Sunday!

Here is a list of resources - and, of course, I must inform you that I am not a tax, legal or accounting professional. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Filing Your Taxes https://www.irs.gov/filing

Publication 17 (2022), Your Federal Income Tax for Individuals, For use in preparing 2022 Returns https://www.irs.gov/publications/p17

Form 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents https://www.irs.gov/uac/about-form-1040ez

Extension of Time to File Your Tax Return https://www.irs.gov/filing/extension-of-time-to-file-your-tax-return

Tax Form Checklist https://www.irs.com/articles/tax-form-checklist

This post was originally published in 2017 and has been updated to reflect the current year.